Nov 28, 2019 'Philip Carret, who wrote The Art of Speculation (1930), believed 'motive' was the test for determining the difference between investment and speculation. Carret connected the investor to the.

Gambling vs Speculation

Gambling and Speculation are popular among those who are interested in making easy money. One cannot deny that money runs the world today. People always thrive to profit, and the easier it is to earn money, the better. With that mindset comes the popularity of gambling and speculation. However, what one might overlook is the fact that even if these two activities seem to have the same goal, several differences do exist between gambling and speculation.

What is Gambling?

Gambling can be defined as the wagering of means on an uncertain event with the aim of gaining additional assets or money. This act is usually carried out in casinos, via lotteries and slot machines while illegal gambling is also carried out all over the world. Gambling requires elements such as consideration, chance, prize, and its outcome makes itself visible within a short amount of time.

The most striking factor about gambling is that only a small amount of money must be paid in anticipation of a large sum of money. One can take the example of the lottery, which requires a fee of a small amount and yet a jackpot of a stupendous amount in return.

What is Speculation?

If one wants to increase his chances to profit one might try to speculate. Just like investment, speculation can be defined as the practice of risky financial transaction with the aim of gaining profit from short or medium term market value fluctuations. In this practice, very little attention is paid to the fundamental market value of a security whereas focus is shed upon price movements. It is also defined as the act of placing funds on a financial vehicle with the intention of getting satisfactory returns over a small amount of time. Speculators show an interest in bonds, stocks, commodity futures, fine art, collectibles, currencies, real estate, and derivatives.

What is the difference between Gambling and Speculation?

Gambling and Speculation are similar in the manner in which they can acquire profit in a short amount of time. However, both these methods are risky enterprises that require one to employ one’s hard earned money in a not-so-stable practice.

• One would need skills to become a good speculator. There are so many factors one would need to study and master to excel in this area. While, gamblers prosper just because of plain luck.

• Gambling is a higher risk activity when compared to speculation. Speculation is a relatively lower risk activity if one studies and practices the art of speculation enough.

In brief: 1. Gambling and speculation are vehicles to profit easily. 2. The probability to succeed in either gambling or speculation is undetermined. 3. The success of a speculator would be because of his skills and knowledge while the success of a gambler would be due to his luck. 4. Gambling can be done without thinking while speculation needs in depth study. 5. Speculation needs a lot more hard work compared to gambling. |

Related posts:

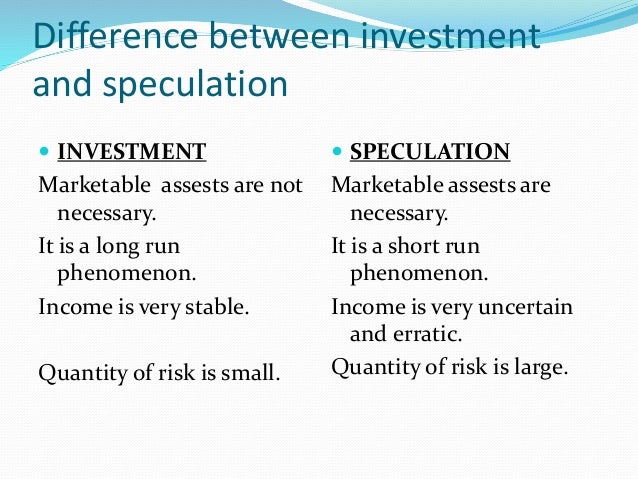

Investment vs Speculation

Speculation and investment are very similar to each other and carry a similar target of making profits. However, these two concepts differ from each other mainly by the level of risk tolerance. While a speculator takes a larger risk, he expects abnormal profits. An investor takes a moderate level of risk and expects satisfactory returns. The following article clearly explains the two concepts and provides a clear distinction between the two.

Investment

Investment in simple is referred to as monitory asset that is purchased with the hope that it would yield income in the future. Investments can be made in a number of forms depending on the investment return the investor requires and the risk that he is willing to take. Investments can be made through the purchase of an asset that is expected to appreciate in value in the future. Examples are the purchase of land, buildings, equipment and machinery.

Investors can also invest their funds in money markets using investment instruments such as bills, bonds, etc. The investment made by an individual depends on their risk appetite and the return that they expect. An investor with a lower risk tolerance may chose to invest in safe securities such as treasury bills and bonds which are very safe but have very low interest. Investors with a high risk tolerance may make risky investments in stock markets that yield higher rates of return.

Speculation

Speculation is the taking of higher risk and standing the possibility of losing all money invested. Speculation is similar to gambling and entails a very high risk that an investor may loose all his money or make very substantial returns if his speculation turns out to be correct. However, it must be noted that speculation is not exactly the same as gambling, because a speculator will take a calculated risk whereas gambling is more of a decision made on chance.

The motivation for an investor to speculate is the possibility of making substantial returns, even though they maybe at the risk of losing all. The following is an example for speculation. An investor decides to invest his funds in the stock market and notices the stock of company ABC is overpriced. In a speculative move, the investor will short sell the stock (short selling is where you borrow stock, sell it at a higher price and buy it back when the prices falls). Once the price falls the stock will be purchased at the lower price and effectively ‘returned’ to its holder. This move is an example of speculation that entails very high risk because if the stock actually increased in price the investor would have made a substantial loss.

Speculation and Investment

Speculation and investment are often times confused by many to be the same thing, even though they are quite different to each other in terms of the asset that is being invested in, the amount of risk taken, investment holding period and the expectations of the investor. The main similarity between investing and speculating is that, in both instances, the investor strives to make a profit and improve his financial returns.

The major difference between the two is the level of risk that is taken on. An investor tries to make satisfactory returns from funds invested by taking lower and moderate levels of risk. A speculator, on the other hand, takes a much larger amount of risk and makes investments that may yield abnormally large profits or equally large losses.

Summary:

Speculation vs Investment

- Speculation and investment are often times confused by many to be the same thing, even though they are quite different to each other in terms of the asset that is being invested in, the amount of risk taken, investment holding period and the expectations of the investor.

- Investment in simple is referred to as monitory asset that is purchased with the hope that it would yield income in the future.

- Speculation is the taking of higher risk and standing the possibility of losing all money invested. Speculation is similar to gambling and entails a very high risk that an investor may lose all his money or make very substantial returns if his speculation turns out to be correct.